VAT 2026: Clarity at last for the hospitality industry – but is that enough?

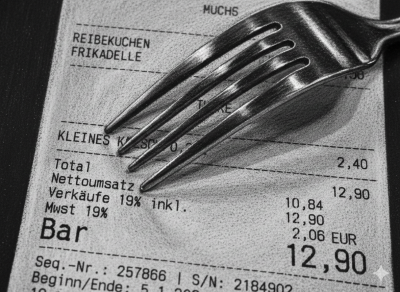

The industry has been breathing a sigh of relief since January 1, 2026. The German government has sent a clear signal and permanently anchored the VAT rate for food at 7%. For us at Walnut Careers, this is more than just a fiscal decision – it is a necessary investment in the viability of German hospitality.